Are you tired of encountering frustrating technical glitches while trying to access the IRS IRIS portal? You’re not alone. The IRS IRIS (Integrated Registration Information System) portal is an essential tool for tax professionals, but it’s no secret that it often falls victim to malfunctions and outages, leaving users feeling exasperated and overwhelmed. Whether you’re a seasoned tax professional or a taxpayer navigating the complexities of the system, dealing with a malfunctioning IRIS portal can be a major roadblock in your financial endeavors. Fear not, as we delve into the intricacies of troubleshooting and offer practical solutions to get the IRS IRIS portal back up and running smoothly.

Understanding the Issue

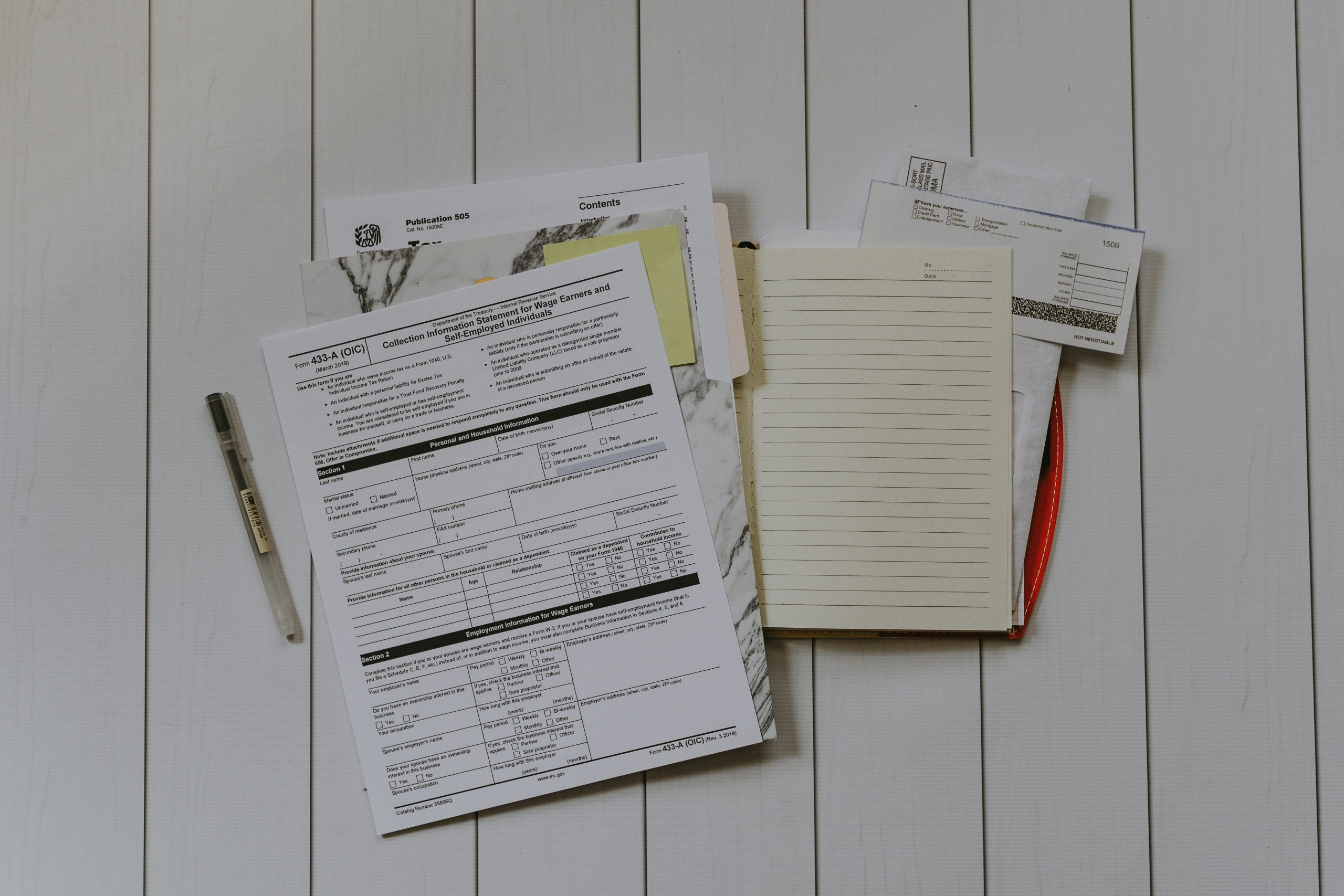

Understanding the issue of the IRS IRIS portal not working requires a deep dive into the complexities surrounding government technology systems. This is not just a simple glitch, but a symptom of larger challenges within the IRS’s infrastructure. It demands an examination of funding, outdated technology, and capacity limitations that have hindered timely updates. Additionally, understanding the issue entails recognizing the impact on taxpayers who rely on the portal for crucial tax-related tasks. Without a functioning system, taxpayers face undue stress and delays in fulfilling their obligations to the government.

Furthermore, grasping this issue involves acknowledging that it goes beyond inconvenience; it can lead to serious financial and legal repercussions for individuals and businesses alike. By understanding these broader implications, we can appreciate why fixing the IRS IRIS portal is imperative and necessary. Moreover, we must recognize that this problem serves as a catalyst for discussing broader improvements in government technology infrastructure and digital services delivery models.

Check for System Updates

Keeping your system up to date is crucial for ensuring the smooth running of any software, including the IRS IRIS portal. Regularly checking for system updates not only helps in resolving potential bugs and glitches but also ensures that you have access to the latest security features. By staying proactive with system updates, users can avoid common issues such as slow loading times and frozen screens when accessing the IRS IRIS portal.

One overlooked benefit of regularly updating your system is improved compatibility with the latest software versions. As technology advances, applications are constantly evolving, and having an outdated operating system can lead to compatibility issues with certain features of the IRS IRIS portal. By being diligent about checking for updates, users can enjoy a seamless experience while using the portal and avoid frustration caused by incompatibility problems.

In addition to addressing specific issues that may be causing problems with the IRS IRIS portal, regular system updates can enhance overall performance and stability. This not only improves user experience but also minimizes the risk of encountering technical difficulties when accessing important tax-related information through the portal. Making it a habit to check for and install available updates will go a long way in keeping your system optimized for smooth operation.

Clear Browser Cache and Cookies

Clearing your browser cache and cookies can often be the solution to numerous technical glitches, including the IRS IRIS portal not working. Over time, these stored files can become corrupted or outdated, causing issues with website functionality. By clearing your cache and cookies, you can effectively remove any problematic data and allow the portal to function as intended. This simple yet powerful step can refresh your browsing experience and potentially resolve any issues you may be facing with accessing the IRS IRIS portal.

Furthermore, clearing browser cache and cookies is a good practice for maintaining online security. These stored files could potentially contain sensitive information that might pose a security risk if left unchecked. By regularly clearing your cache and cookies, you can mitigate these risks and ensure a safer browsing experience overall. So in addition to fixing immediate issues with the IRS IRIS portal not working, taking this proactive measure will contribute to better privacy protection while using the internet.

Contact IRS Support

Contacting IRS support can be a vital step in resolving issues with the IRIS portal. With the portal not working as expected for many users, reaching out to the IRS support team can provide crucial assistance. One effective way to contact IRS support is through their dedicated helpline, where knowledgeable agents can guide you through troubleshooting steps and offer personalized solutions to your specific portal problems. Additionally, utilizing the live chat feature on the IRS website can allow for real-time communication with support staff, providing immediate help and reducing wait times for resolution.

Another avenue to explore is social media platforms, where the IRS maintains a presence and offers support through direct messaging or public interaction. Engaging with their social media accounts could potentially expedite getting assistance, leveraging a more modern channel of communication. By seeking help proactively through these available avenues, individuals experiencing issues with the IRIS portal can increase their chances of swift resolution and get back on track with managing their tax-related tasks efficiently.

Troubleshoot Network Connection

Have you ever encountered the frustrating dilemma of a network connection issue when trying to access crucial online portals like the IRS IRIS portal? Don’t worry – you’re not alone. Troubleshooting network connections can be a daunting task, but with the right approach, it’s entirely manageable. Firstly, double-check your internet connection by restarting your router and ensuring that all cables are securely connected. Next, verify that your device’s Wi-Fi or Ethernet settings are correctly configured and that there are no conflicting IP addresses.

If the problem persists, try accessing the IRS IRIS portal from another device to determine if the issue lies with your specific computer or device. Additionally, consider reaching out to your internet service provider for assistance as they may be able to identify any network-related problems on their end. Remember that patience is key when troubleshooting network connections – persistence often leads to a successful resolution. With these tips in mind, you’ll soon be navigating the IRS IRIS portal effortlessly once again.

Consider Using Alternative Filing Methods

When dealing with a problematic IRS IRIS portal, it might be time to consider using alternative filing methods. One option could be to utilize the services of a qualified tax professional who can assist in navigating through the IRS requirements and submitting the necessary documents on your behalf. Another alternative method is to explore e-file options offered by reputable third-party tax software providers, which can streamline the process and ensure timely submission of your tax returns. By considering these alternative filing methods, taxpayers can avoid potential frustrations associated with technical glitches and system downtime while still meeting their tax obligations.

Exploring alternative filing methods also opens up avenues for utilizing secure online platforms that may be more reliable than government-operated systems. Additionally, seeking help from professionals or third-party software companies can provide peace of mind in ensuring that your taxes are accurately filed and submitted within deadline constraints. Embracing these alternatives not only offers practical solutions for dealing with a malfunctioning IRS portal but also empowers taxpayers to proactively manage their tax responsibilities in an efficient manner.

Conclusion: Resolving IRS IRIS Portal Issues

In conclusion, resolving IRS IRIS Portal issues requires a multi-faceted approach that involves not only technical troubleshooting but also clear communication with the IRS itself. While technical glitches can often be resolved by clearing cache, updating browser settings, or seeking assistance from IT professionals, the underlying bureaucratic processes within the IRS must also be considered. It’s crucial to stay updated on any official communications from the IRS regarding portal maintenance or system updates as this can provide valuable insight into ongoing issues and potential resolutions.

Moreover, engaging in proactive dialogue with IRS representatives can shed light on individual case-specific concerns and help navigate through complex tax-related matters. This personalized approach may unearth underlying causes of portal malfunction that are unique to each taxpayer’s situation, ultimately leading to a more tailored and effective resolution process. Ultimately, fostering a proactive attitude towards these issues is key to effecting lasting change in how we interact with the IRIS portal for tax-related matters.