If you’ve ever tried paying for Apple iTunes, buying ebooks, or shopping on Amazon from Nigeria, then you already know the struggle of finding a payment method that actually works. Especially when Naira cards weren’t accepted for international payments, it felt almost impossible to get things done.

To solve this huge payment problem, fintech companies introduced virtual dollar cards. These cards let you spend in dollars while funding them directly with Naira, and you can even link them to PayPal for more payment flexibility.

Understandably, Naira cards are now accepted for foreign payment, but if you’ve used them, you’ll agree they’re not always the most reliable. Virtual dollar cards are still faster, more stable, and give you fewer headaches.

So, whether you’re new to them or looking for a better option, here are six of the best apps to get a dollar virtual card in Nigeria.

Top 6 Apps to Get Virtual Dollar Cards in Nigeria

If you’re looking to create a virtual dollar card, here’s how popular platforms like Cardtonic, Bitisika, UfitPay, Gomoney, Klasha, and Trove compare in terms of card creation fees, funding currencies, and monthly spending limits.

| s/n | Apps | Card Creation Fee | Funding Currency | Monthly Spending Limit |

| 1. | Cardtonic | $1.5 | Naira, Cedis | Unlimited |

| 2. | Bitisika | $3 | Naira, Cryptocurrencies | $500,000 |

| 3. | UfitPay | $1.6 | Naira, Cedis | $2000 |

| 4. | Gomoney | Free (first card) | Naira | $100 |

| 5. | Klasha | $2 | Naira | Unlimited |

| 6. | Trove | $2 | Naira | $10,000 |

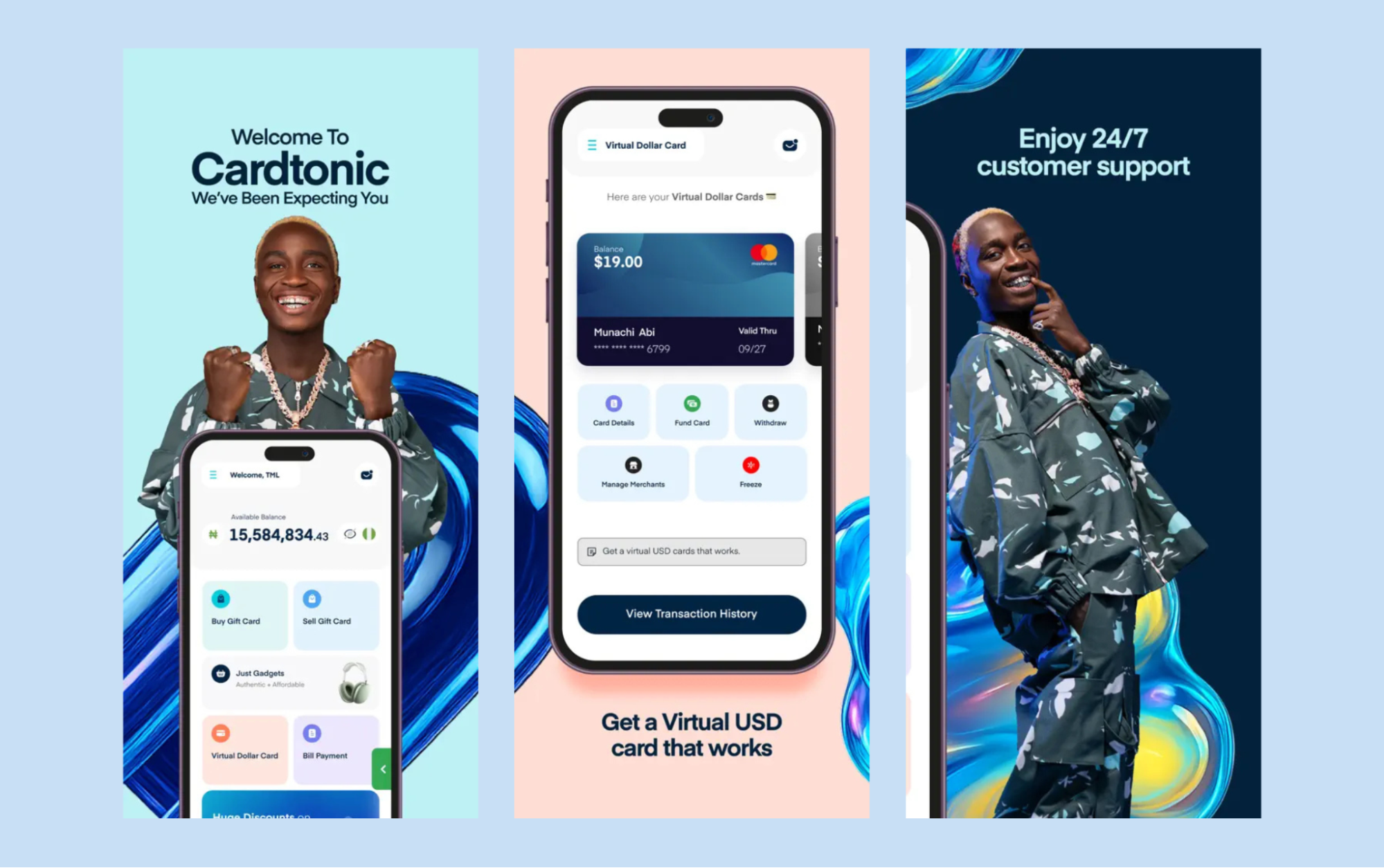

1. Cardtonic

Cardtonic’s virtual dollar card is easily one of the best options Nigerians can use for foreign transactions. Backed by Cardtonic, one of Nigeria’s top fintech brands, the card is affordable and super reliable.

This card only costs $1.5 to create, with zero maintenance fees. And you can decide to pick between MasterCard or a Visa option, depending on your choice.

You also don’t need a domiciliary account to use this card. Just fund your Cardtonic card with Naira, and it automatically converts to dollars at the current exchange rate during transactions. The whole process is smooth, and the card rarely gives issues when using it.

At this point, your next question should be, “how can I create a virtual dollar card” with Cardtonic?

Well, getting started is stress-free. All you have to do is download the app, sign up, fund your wallet with Naira, and click on the virtual dollar card option. The cost or funding for the card will be taken from your wallet balance. Follow the steps, and you’ll have your card ready in less than a minute.

The best part is that, aside from getting a virtual dollar card, you can use this app to sort out other online bill payments like electricity and cable.

2. Bitsika

Anybody trading cryptocurrencies should hop on this virtual dollar card to handle foreign transactions. Bitsika’s virtual dollar card is a prepaid reloadable card that works in over 200 countries, and costs just $3 to get.

The card is also compatible with Apple Pay, Google Pay, and PayPal, making it easier to pay for more things online. Since the card is funded directly with cryptocurrencies, it is cheaper and more cost-effective. You don’t need to convert your crypto to Naira and then back to dollars before making payments.

To get started, download the Bitisika app and create an account. Fund your Bitisika wallet with cryptocurrencies and proceed to place an order for your virtual dollar card. You don’t need any strict identification or KYC process to get your virtual dollar card.

3. UfitPay

UfitPay is another trusted virtual dollar card issuer you can use as a Nigerian. The card is multicurrency and supports spending in dollars. Luckily, Naira is one of the currencies accepted. With this virtual dollar card, you can spend up to $2000 every month in dollars, while your Naira spending is unlimited.

One thing that makes UfitPay stand out is its dual wallet system. Your single account comes with both a Naira wallet and a dollar wallet. You can use either one to fund your card, but it is best to fund your virtual dollar card through the dollar wallet.

You can also transfer money between your Naira wallet and dollar wallet. This makes it perfect for freelancers who get paid in dollars and need the flexibility of converting or spending directly in dollars or naira.

4. Gomoney

If you are not a heavy spender, Gomoney’s virtual dollar card is a great option. The card has a $100 spending limit per user, but your first card is free. You can use it for subscription payments or when ordering goods online.

The Gomoney app also comes with a feature that helps you control your spending. It gives you a monthly breakdown of all your expenses, making it one of the best cards for you if you want to manage your finances while still being able to pay for services anytime.

To get started, download the Gomoney app, fund your wallet, and click on virtual dollar card.

5. Klasha

Klasha’s virtual dollar card is perfect for Africans who love shopping from sites like Shein, Aliexpress, or Amazon. It is designed to give Nigerians and other African users the ultimate global shopping experience.

The Klasha app supports multicurrency accounts and allows you to fund your card directly with Naira, which makes online shopping much more convenient.

Getting a Klasha virtual dollar card costs just about $2. To get the card, download the app, create your account by filling in your personal information, and request a virtual dollar card. In less than a minute, your card will be ready to use, and you can start shopping internationally.

6. Trove

Trove is mostly known as an investment app that lets Nigerians buy both local and foreign stocks. Alongside its investment features, the app also offers a virtual dollar card that you can use for international transactions.

The card costs about $2 to create and comes with a spending limit of up to $10,000. To get the card, simply download the app, sign up with your details, complete the ID verification, and request a virtual dollar card. You should have it ready in just a few minutes.

Frequently Asked Questions on Getting a Dollar Virtual Card in Nigeria

- What is the Best App to Get a Virtual Dollar Card in Nigeria?

Cardtonic is one of the best apps to get a virtual dollar card in Nigeria. It offers cards supported by either Mastercard or Visa, giving you the flexibility to choose. Both cards work perfectly for making online purchases and payments globally.

The card creation fee is about $1.50, with no extra maintenance charges. You can get yours by simply downloading the Cardtonic app and signing up.

- How Can I Create a Virtual Dollar Card?

If you are wondering how to get a virtual dollar card in Nigeria, the process is simple. Start by choosing a trusted card issuer like Cardtonic. Download the app, create an account, and fund your wallet with the acceptable currency. Afterwards, click on “Get Virtual Dollar Card” and your card will be ready in just a few minutes.

- Do I Need A Domiciliary Account to Get a Virtual Dollar Card?

No, you don’t need a domiciliary account to get a virtual dollar card. With apps like Cardtonic, you can fund your card directly from your Naira wallet, and the money will be converted to the dollar equivalent when making payments. This makes the process of creating a virtual dollar card simple and convenient, without the stress of opening a domiciliary account.

- Can I Use my Virtual Dollar Card for All Online Payments?

Yes, you can use your virtual dollar card to process all transactions if you get the card from a good source. For example, a Cardtonic virtual dollar card can be used to buy goods and pay for all online services.

- How Much Does It Cost to Get a Virtual Dollar Card in Naira?

The cost of a virtual dollar card depends on the provider. On average, it ranges between $1 and $10, which is roughly ₦1,500 to ₦15,000 depending on the exchange rate. Some apps even issue the first card for free.

Conclusion

Virtual dollar cards remain one of the easiest ways for Nigerians to shop, subscribe, and pay for services online in 2025. Whether you prefer affordable options like Cardtonic and Gomoney, or specialised ones like Trove, there’s a card that fits your needs. Select the option that suits your lifestyle, and enjoy your international payments with ease.